Whats is a Credit Score ?

- A credit score is a three-digit number (300-900) that indicates to banks and other lenders how likely you are to pay back the money you borrowed. Based on this, they decide whether to give you a loan/credit card or not and at what rate of interest/credit limit, respectively. In other words, they use this score to determine whether you are ‘worthy of credit’ or not. Hence, in financial terms, we say the credit score represents the ‘credit worthiness’ of a customer.

Where can I get my Credit Score ?

- There are four credit scoring agencies, also called credit bureaus, that give you credit scores - TransUnion CIBIL, Experian, Equifax, and CRIF High Mark. Each credit bureau uses its own set of formulas and algorithms to calculate the score for every individual. Hence, each bureau’s credit score differs from the other

How often can I check my Credit Score ?

- You are entitled to avail one free credit report per year from each credit bureau.

Is there any other way to check my score for free ?

- Yes, you can fetch a free credit report from your payment app like Paytm, Gpay, Freerecharge etc..

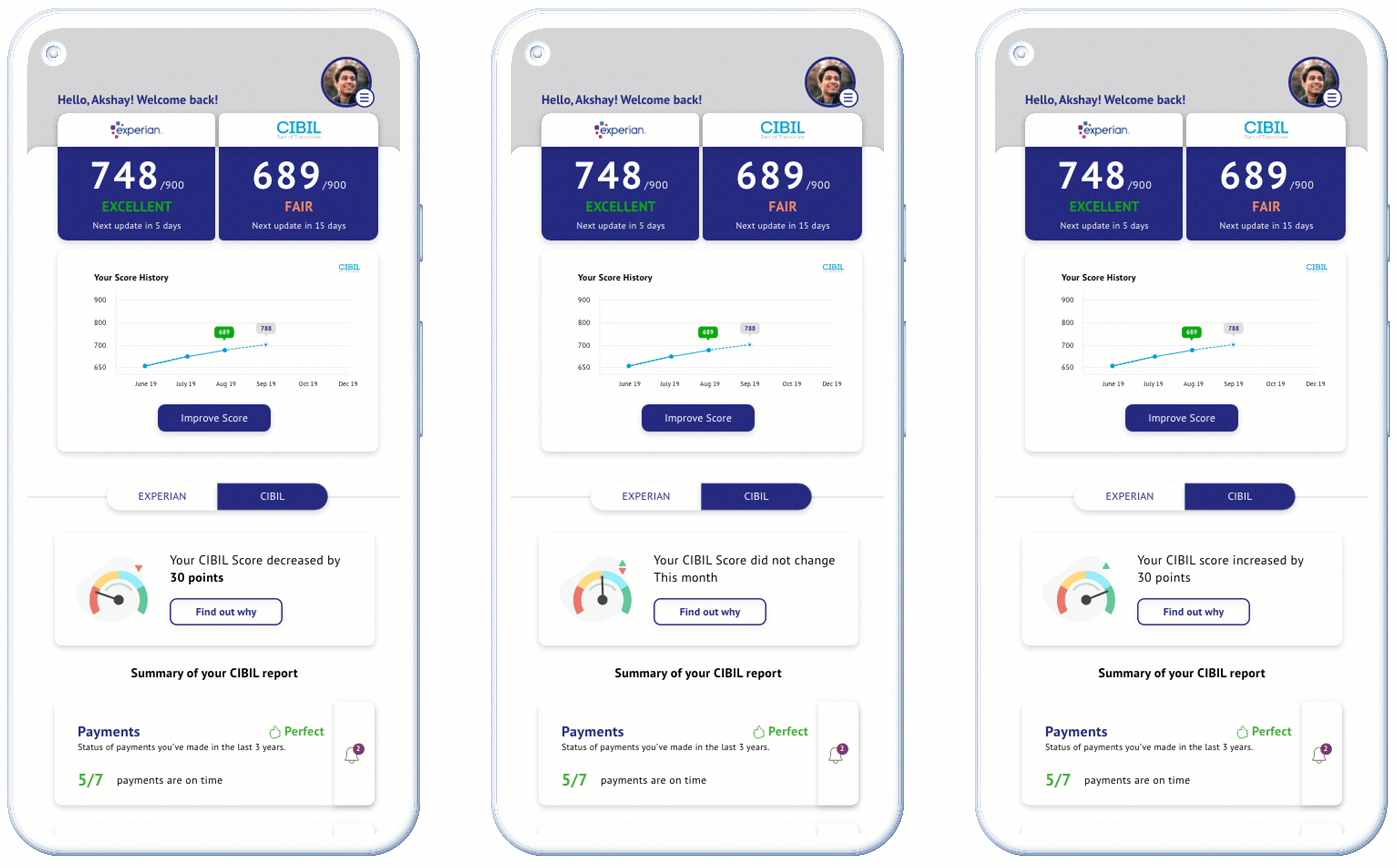

- One Score: It is app developed by FPL technology which provides you monthly credit report and score from CIBIL & Experian.

- CRED: Another payment app also provides you with one free update on credit report & score from CIBIL & Experian.

- You can also try Bankbazzar.com & Paisabazaar.com but they might spam you.

My personal suggestion is to use One Score App/ Gpay/ Cred to constantly monitor your credit score.

What does my credit report contains ?

The credit report of an individual is constituted from data shared by various banks and financial institutions to collate into one comprehensive document. It is a compilation of data on the entire spectrum of the customer’s credit related activity including details on repayment record, credit card limit, previous application for loans or credit card, any settled or written off loans and any other credit related activity.

Broadly, there are following sections in a credit report:

- Credit score: It is the credit score, which is calculated on the basis of your credit history. It ranges between300-900.

- Personal information: Includes your name, date of birth, gender and KYC.

- Contact information: Address and contact numbers. It may include up to last 4 addresses.

- Employment information: Monthly or annual income details as provided by the banks and financial institutions.

- Account information: This section includes the details of your credit facilities, account numbers and types, current balance and a monthly record (of up to 3 years) of your payments.

- Enquiry information: Every time you apply for a loan or credit card, the respective bank or financial institution accesses your credit report. The system makes a note of the activity in your credit history and marked it as Enquiries.

What is a good Credit Score ?

Score of more than 750 is generally considered good. It is desirable to maintain CIBIL >750 for easy approval and better offers on Loan & credit cards.

Comments

Post a Comment